Overview Of The Fintech Industry In 2023

By 2023, the financial technology (fintech) industry is projected to continue growing and evolving significantly. Specifically, according to Expert Market Research, the estimated value of the worldwide fintech market in 2022 was at $194.1 billion, and it is anticipated to increase between 2023 and 2028 at a CAGR of 16.8% to reach $492.81 billion.

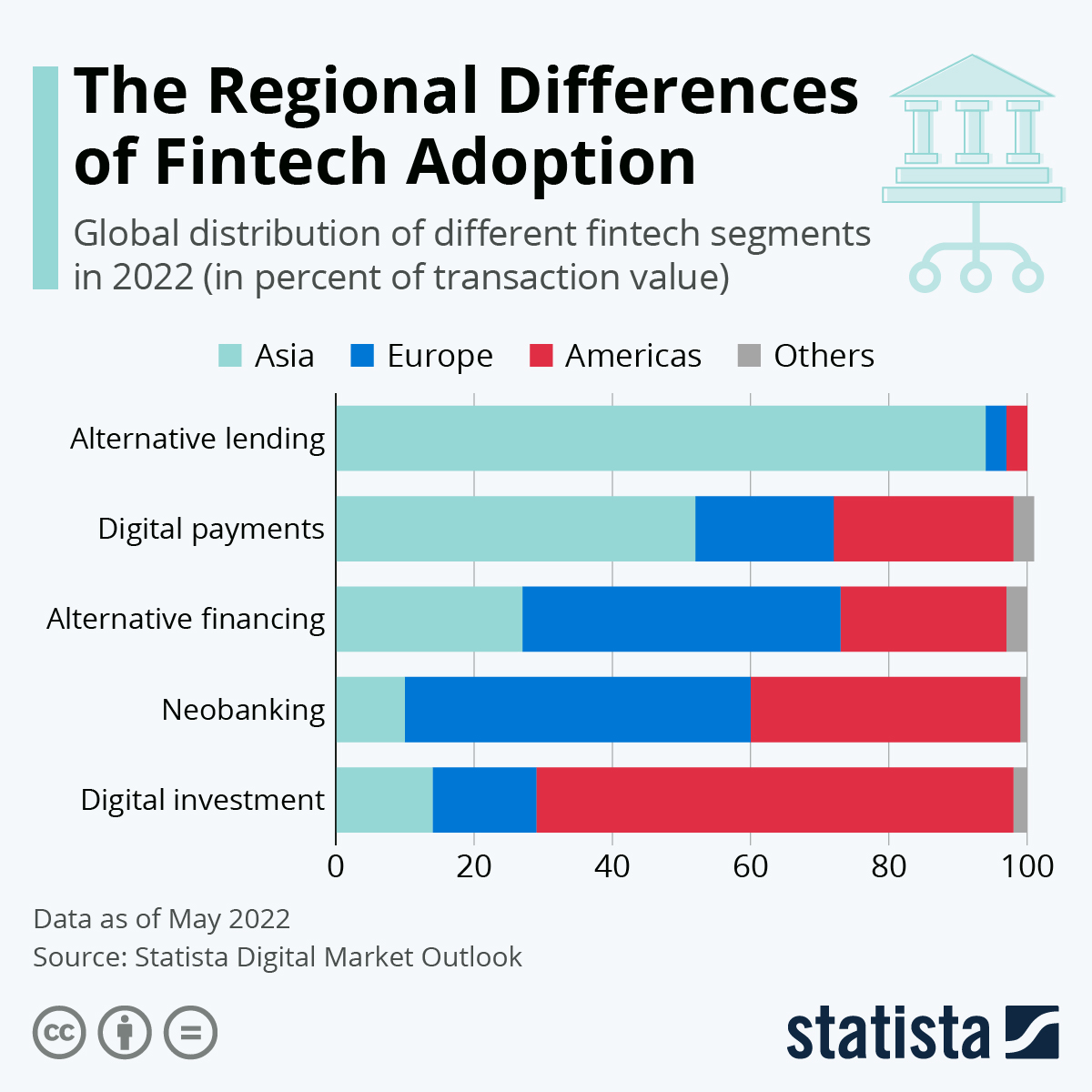

Additionally, it is widely expected that fintech solutions will have infiltrated numerous aspects of our lives and become more widely adopted all around the globe as businesses continue to look for faster, more efficient ways to carry out financial transactions. From online banking, peer-to-peer payments, investing and crowdfunding opportunities, to AI-driven insurance solutions, fintech promises convenience and profitability for many of its users.  You will find more infographics at Statista

You will find more infographics at Statista

As technological advancements happen a break-neck speed, changes in the fintech sector can be expected over the next five years; however, it still remains to be seen what kind of seismic shifts will come along with it and how they’ll shape not only the finance world but also our daily lives. Without a doubt though by 2023, fintech will be embedded into our everyday way of life.

The Benefits And Potential Opportunities Of Fintech

Fintech has made it easier to do numerous financial transactions, including funding and payments. Also, fintech offers better financial sector implementation. As a result, consumers can do various financial tasks more rapidly. To be more specific, some notable and valuable advantages on fintech including:

| Higher Efficiency | Fintech solutions are geared towards automating financial processes which makes it faster to do transactions and processes, like payments and investments. |

| Reduced Costs | With the automation of services, companies can save costs for manual labor as well as time. |

| More Options & Accessibility | Thanks to fintech, people now have access to a more diverse range of financial options, such as peer-to-peer lending, payments and insurance. |

| Robo Advisors | Many fintech companies offer automated advisory services that help investors make informed decisions about their investments. |

Besides, the opportunities for fintech development are still very open. Statista presented that the United States had 10,755 fintech (financial technology) startups as of November 2021, making it the country with the most such startups worldwide. Comparatively, the EMEA (Europe, the Middle East, and Africa) region saw 9,323 such startups, while the Asia Pacific region saw 6,268. Businesses have to catch up with current fintech trends in order to remain competitive position in this market, some emerging technologies can be mentioned as:

Contactless Payment Contactless payments involve the use of near-field communication technology to securely transmit payment information between two devices.

Blockchain Blockchain technology is a secure and transparent way to track and store data in a distributed ledger system, enabling faster payments and financial transactions.

Open Banking Open banking is a form of banking that allows third-party developers to access banking data from customers, and use it to develop new financial services.

Understanding The Risks Involved In Fintech

One of the sectors with the quickest growth in the modern period is fintech. Unfortunately, because of the fierce competition and low success rates in the sector, the majority of businesses fail. Here are some statistics on the startup failure rates in the fintech sector.

+ About 75 percent of financial firms fail within last 20 years.

+ 10% of newly established companies fail within the first year.

+ The majority of US startups fail, with the technology sector having the greatest failure rate.

Apart from that, financial technology also came up with many limits and risks, such as:

| Data Security | With the increased use of technology, data security is becoming a greater concern with the potential for hackers to gain access to sensitive financial information. |

| Regulatory Compli-ance | Fintech companies must comply with constantly changing regulations in order to remain operational which can be difficult as rules often change at short notice. |

| Customer Service | As fintech companies are often online only, customer service can suffer due to lack of face-to-face interaction. |

| Reputation Risk | Reputational risk is a major concern for any financial business and fintech companies must ensure that they adhere to ethical standards so as not to damage their reputation. |

Examples Of Successful Fintech Companies

Despite the risks and failures in the fintech industry, there are numerous successful companies that have achieved success. Here are some examples of notable fintech startups:

Chime: Chime is a digital banking service that offers customers no-fee bank accounts, debit cards, budgeting features and more. It has become one of the most successful fintechs in the United States with over 12 million users.

Chipper Cash: Chipper Cash is an online payment platform that allows users to send and receive money internationally, as well as pay bills. It has become increasingly popular with over 5 million users across the global.

Square: Square is a point-of-sale and mobile payment platform founded by Twitter CEO Jack Dorsey. It has become one of the most widely used fintechs in the world, with over 24 million monthly active users.

These are just some examples of successful fintech startups. As technology continues to evolve, we can expect to see more and more fintech companies emerge in the future. With the right planning, strategy, and execution, these startups can have a positive impact on society by creating innovative financial services that benefit both businesses and customers alike.

Conclusion

Overall, fintech companies have the potential to revolutionize how financial services are provided. With the right strategy and execution, these startups can provide innovative solutions that benefit both businesses and customers alike. However, investing in a fintech company is not without risks; it is important for investors to do their research before making any decisions. By diversifying investments and taking calculated risks with safety measures in place, investors can reduce their overall risk exposure while potentially reaping rewards from successful startup investments. As technology continues to evolve, we will likely see more and more disruptive fintechs emerge on the market – so keep your eye out!